By Sean O’Leary

Senior Policy Analyst

West Virginia Center on Budget and Policy

It’s almost Halloween, that scary time of year of ghosts, goblins, and the promise to eliminate the tax on your car (or hearse). And there is nothing more terror-inducing than ill-advised tax cuts and the loss of local control. So turn out all the lights, hide under a blanket, and get ready to have your bones rattle as you read these four ghoulish charts about Amendment 2.

What is Amendment 2? If passed, Amendment 2 would amend the constitution to give the state legislature the authority to exempt business machinery and equipment, business inventory, and personal vehicles from local property taxation. Despite much of the rhetoric around the amendment, it does not actually eliminate the “car tax” itself. Instead, it simply gives the legislature the authority to do so, along with a host of other taxes. Notably, the amendment says nothing about replacing the lost revenue for counties, schools, and municipalities, and the legislature would not be required to replace any of the lost revenue. While the constitution currently protects local revenue, that protection would be significantly weakened by Amendment 2.

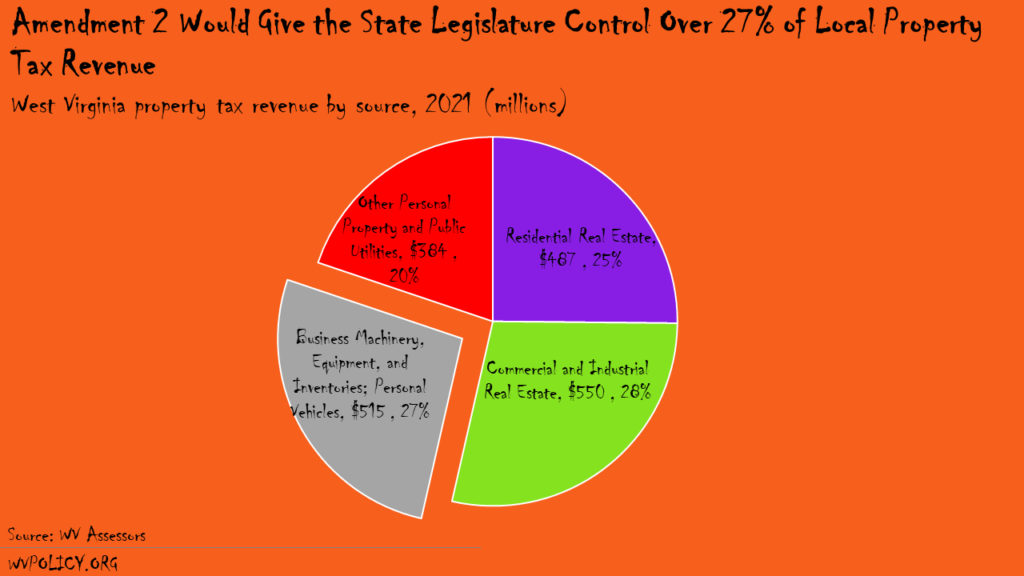

Amendment 2 would give the legislature control over 27 percent of total property tax revenue in the state–over $515 million–resulting in a severe loss of revenue for counties, municipalities, and school districts and marking a significant shift in power away from local governments and to state government.

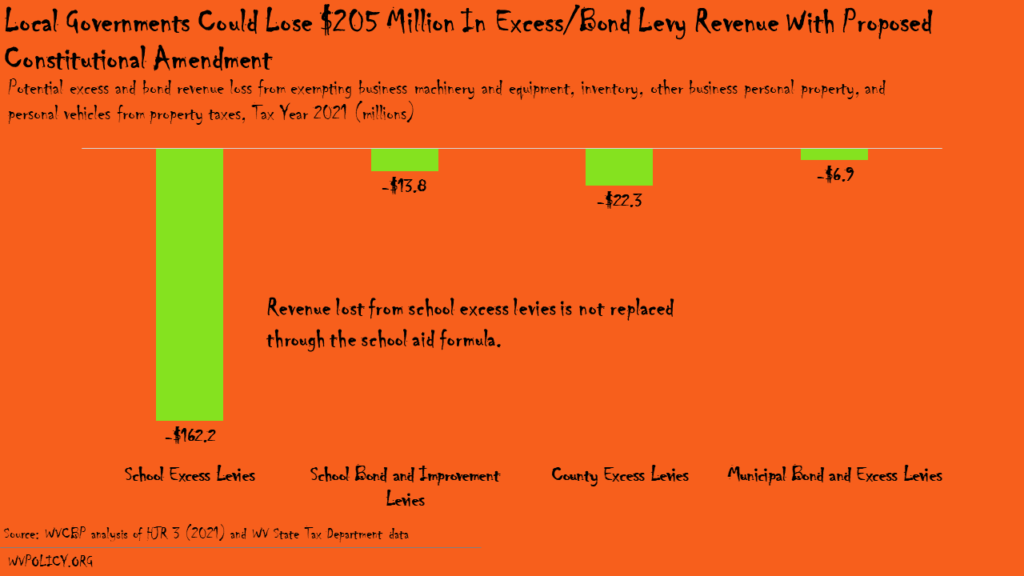

Of that $515 million, approximately $340 million funds local school districts, $138 million funds county government services, $35 million funds municipal government services, and only $2 million funds state government services. What’s more, $205 million of the $515 million comes from excess and bond levies that have already been approved by voters in those counties. But if passed, Amendment 2 would take control of the full $515 million away from local governments and voters and give it to the state legislature.

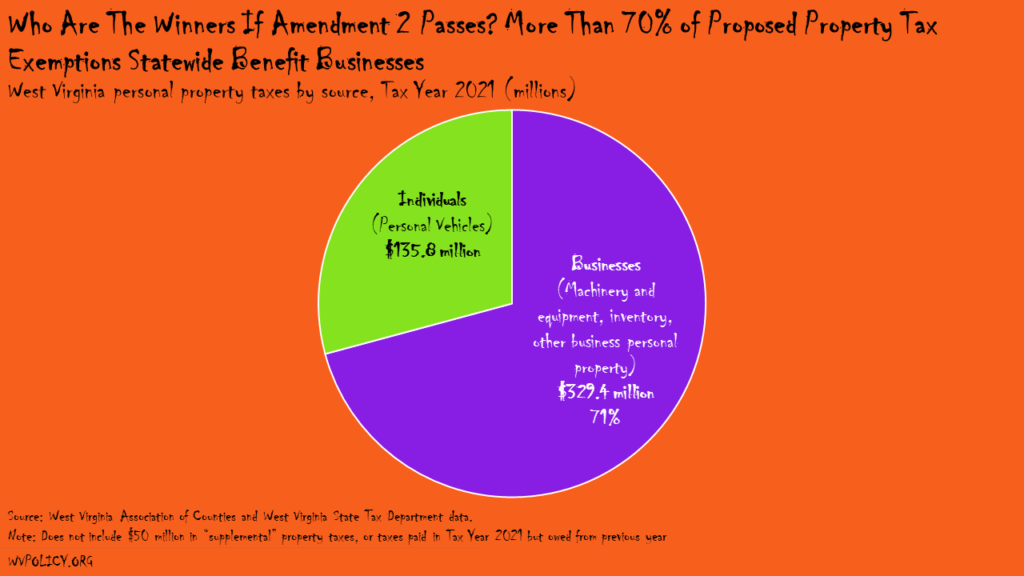

While the proposal has been framed by proponents as “relief for taxpayers from their car tax,” over 70 percent of the potential tax cuts would go to businesses. The property tax on individual vehicles accounts for less than one-third of the potential tax cuts included in Amendment 2. Further, industrial property taxes are highly exportable, meaning very little of the savings would stay in West Virginia, instead largely flowing to businesses headquartered out-of-state.

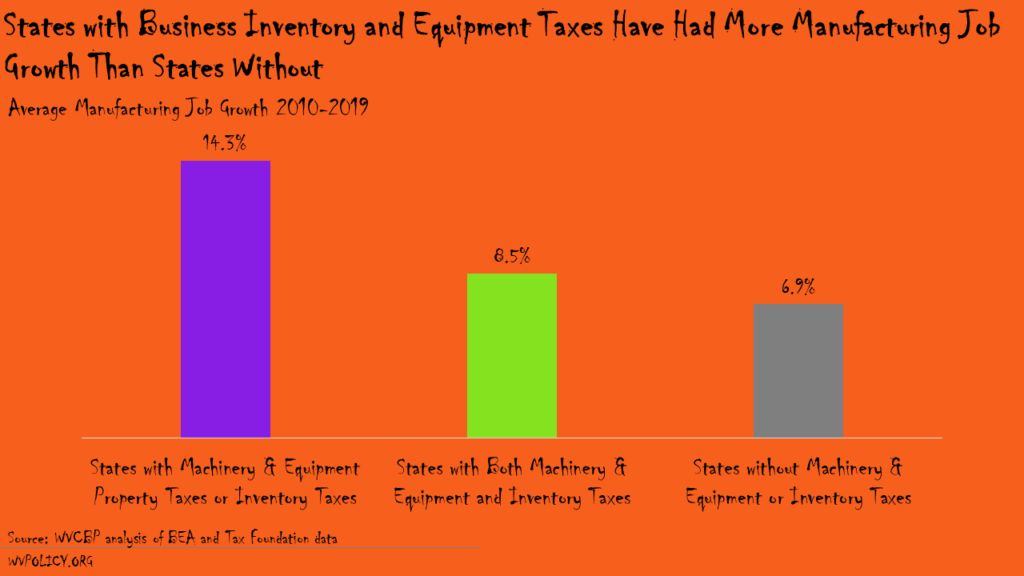

Claims that eliminating the property tax on business machinery, equipment, and inventory would result in rapid job growth in the state are largely unsupported. Academic research on the impact of the tax is limited and mixed at best, while industry-backed studies are highly flawed and fail to show that elimination of the tax can actually hurt growth. In fact, during the last decade-long economic expansion, states with property taxes on business machinery, equipment, and inventory saw more manufacturing job growth on average than the states without the tax.

So this Halloween, don’t be tricked, Amendment 2 is no treat.